2/08/2024

ttps://moneywise.com/banking/small-business-owners-bank-deposit-disappears

Congress needs to assure WE THE PEOPLE that banks are safe for our money.

TRENDING

210,600 people read this week

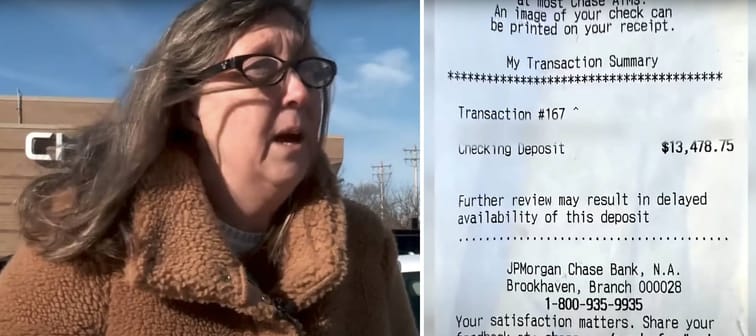

‘Us small guys need some help’: Oklahoma woman deposited $13.5K into her account, but the money didn’t show up — leaving her scrambling to pay the bills. What to do if your deposit disappears

Every small business owner’s worst nightmare. KFOR Oklahoma’s News 4 / YouTube

KFOR Oklahoma’s News 4 / YouTube

We adhere to strict standards of editorial integrity to help you make decisions with confidence. Please be aware that some (or all) products and services linked in this article are from our sponsors.By Bethan Moorcraft

Nothing quite stirs a small business owner’s financial anxiety like money vanishing into thin air.

Just ask Carla Garling — a physical therapist with a private practice in Norman, Oklahoma — who says her $13,500 check deposit failed to show up in her Chase bank account in January, leaving her scrambling to pay her employees and bills.

Don’t miss

- Commercial real estate has topped the stock market for over 25 years — but only the elite had access. Now you can super-spike your wealth even if you’re just an everyday investor

- Inflation is still white-hot in 2024 — use these 3 ‘real assets’ to protect your wealth today, no matter what the US Fed does or says

- Anything can happen in 2024. Try these 5 easy money hacks to help you make and save thousands of dollars in the new year (they will only take seconds)

“I’m trying to be patient, I’m trying to be kind about it, but I’ve got bills to pay,” she told KFOR Oklahoma’s News 4, who stepped in to investigate the missing cash. “For a small business like mine, it can be detrimental really quickly.”

Bank staff allegedly told Garling they didn’t know if or when the money would land in her account — even though she had a deposit slip showing proof of the transaction.

When News 4 stepped in on her behalf, it got the ball rolling and the bank promised to credit Garland’s account and post her money that same week.

“I just appreciate you all coming out and giving me a hand,” she said. “Us small guys need some help.”

Here’s how bank deposits should work and what you can do if your money doesn’t materialize in your account.

How bank deposits (normally) work

Under the federal Regulation CC, banks and credit unions are legally required to make your deposited funds available within a specific time frame — but it’s not always a perfect science, as Garland’s experience indicates.

Generally, if you deposit cash or checks for $200 or less in person to a bank employee, you should be able to access the full amount the next business day, according to the Consumer Finance Protection Bureau. If you deposit funds over $200, you should be able to access $200 the next business day, and the rest of the money the second business day. If you deposit your funds through an ATM at your bank, you should be able to withdraw or use that money on the second business day.

Sometimes banks or credit unions may make your money available quicker than the law requires — especially if they’re hyper-focused on customer service — and some may do so for an extra fee. If you’re not sure when to expect your funds, you can ask your bank or credit union for their deposit policy.

Remember, different banks may have different cut-off times for what they consider to be the end of the business day. If you make your deposit after the cut-off time, your bank could treat your deposit as if you made it the next business day.

Read more: Unlocking financial prosperity: Jeff Bezos shares the path to prime earnings through hassle-free real estate investment — don’t miss out on this opportunity to revolutionize your financial future

When banks are allowed to delay funds availability

Under certain circumstances, Regulation CC does allow financial institutions to delay the availability of funds for a “reasonable period of time.”

A “reasonable” time period is generally defined as one additional business day (making a total of two business days) for checks, and five additional business days (total of seven) for nonlocal checks — these are checks deposited in a different check processing region than the paying bank.

That delay may occur if:

- You make a deposit over $5,000

- Your account has been overdrawn too many times in the past six months

- You made the deposit at an ATM owned by someone other than your bank or credit union

- Your bank or credit union has cause to doubt the collectability of your check (e.g. if the check is dated more than six months earlier)

- You or your bank redeposit a check that has been returned unpaid.

Chase did not confirm the cause of the delay in Garland’s case.

kommonsentsjane