7/2/2023

Wealthy Nickel

“They Dug Their Own Graves”: Elon Musk On Housing Bubble

Story by Andrew Herrig • 1h ago

Tesla CEO Elon Musk has no shortage of opinions to share on Twitter, from his views on cryptocurrency to claiming that Tesla stock prices are too high.

The latter tweet wiped $14 billion off the company’s value with just seven words, so to say his opinions can move markets is an understatement.

Now Musk has turned his attention to the housing bubble in response to a tweet by Dogecoin co-founder Billy Markus, who goes by the name Shibetoshi Nakamoto on Twitter.

Predatory Lending Led to the Housing Bubble Burst?

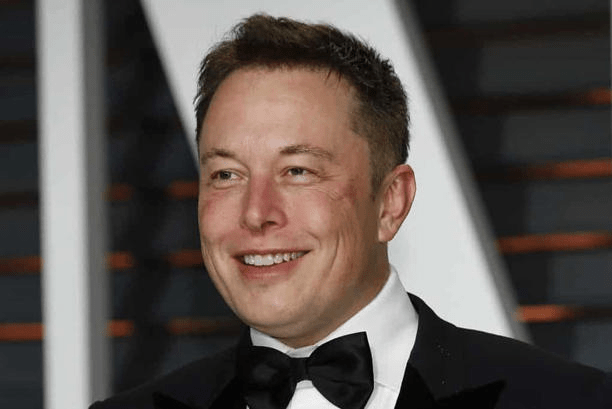

Image Courtesy Kathy Hutchins and Shutterstock.

© Provided by Wealthy Nickel

In the Tweet, Markus claimed that cryptocurrency was originally created in response to the heavy hand of central bank control following the 2008 recession that led to the rampant printing of money and bailouts.

The decentralized nature of cryptocurrency could avoid manipulation by governments because, in essence, no one was in control of it other than a pre-defined algorithm.

Markus also blamed the 2008 recession on predatory lending practices during that time that were allowing previously unqualified buyers to purchase homes with little to no money down and low initial mortgage payments that ballooned over time.

Musk Disagrees – ‘They Dug Their Own Grave

Musk responded to the tweet with his opinion that the fundamental error made during the 2008 recession was assuming that housing prices only go up.

He was careful to note that he doesn’t support predatory lending, but he also said that many of those same lenders were severely wounded or didn’t survive the housing market collapse. “They dug their own graves – a lesson we should all take to heart, including me,” he stated.

In Musk’s view, the critical error made by lenders that caused them to lower lending standards and led to their demise was an “axiomatic error” that housing prices could never decline.

Lessons Learned in the Current Housing Market?

With rising interest rates and inflation hammering the current housing market, it remains to be seen if lessons were learned from the housing crisis 14 years ago.

A huge run up in prices following the 2020 COVID-19 pandemic, as remote work changed the housing market and buyers rushed in to pay whatever it cost in fear that prices would only continue to go up.

With the recent rise in mortgage rates – doubling in a matter of months – the interest portion of monthly mortgage payments has skyrocketed for new purchases, potentially adding an extra $1,000 or more and putting a dent in affordability.

This affordability crisis has brought the rise in home prices to a screeching halt, but only time will tell if the housing market will stay more resilient this time around.

Hopefully in 2023, the main lesson Musk pointed out from the 2008 crisis has not been forgotten – housing prices do not always go up.

****

The only way in today’s housing market that I would buy a house is if I were financially able is TO PAY CASH.

How US housing prices changed during the pandemic The price increases account for 19% of increasing value since 1991. Published on Wed, July 7, 2021 8:39AM PDT | Updated Wed, July 21, 2021 9:10AM PDT The US housing market had its largest rise in single-family home prices in almost 30 years.

Housing priced at $100,000 in 1967 → $1,027,250.12 in 2023

Housing Inflation Calculator

Prices for Housing, 1967-2023 ($100,000)

According to the U.S. Bureau of Labor Statistics, prices for housing are 927.25% higher in 2023 versus 1967 (a $927,250.12 difference in value).

Between 1967 and 2023: Housing experienced an average inflation rate of 4.25% per year. This rate of change indicates significant inflation. In other words, housing costing $100,000 in the year 1967 would cost $1,027,250.12 in 2023 for an equivalent purchase. Compared to the overall inflation rate of 4.01% during this same period, inflation for housing was higher.

*****

ttps://www.cnbc.com/2017/06/27/warren-buffett-says-the-problem-with-the-economy-is-people-like-him.html

From where I sit – when people become too rich – they use their power to hurt the poor people. Democrats and Elite Republicans want to keep the people poor instead of lifting them up. But, there are people who won’t help themselves no matter what the government does. Look at all of the people living on the streets of the U.S. because they do not want any responsibility and want drugs. Are they being paid to live in that manner?

So – it seems, no matter what the government does – there are some people who want to be free loaders.

kommonsentsjane